2012 South Carolina Individual income tax rates

South Carolina uses the following income tax brackets for all taxpayers regardless of their filing status.

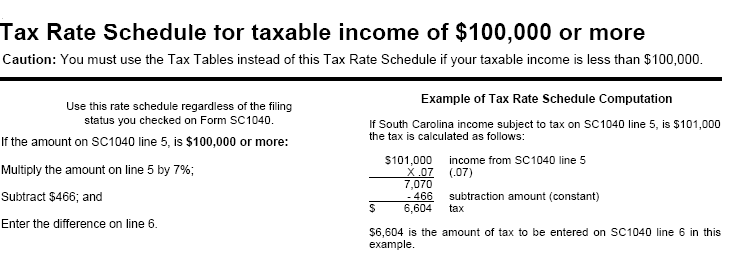

You can use the tax rate table to get a rough idea of your tax liability but you must use the 2012 SC Tax tables to compute your actual tax.

|

If taxable income is: |

The tax is: |

|

Not over $2,760 |

0% of the taxable income |

|

Over $2,760 but not over $5,520 |

3% of the excess over $2,760 |

|

Over $5,520 but not over $8,280 |

4% of the excess over $5,520 + $82.80 |

|

Over $8,280 but not over $11,040 |

5% of the excess over $8,280 + $193.20 |

|

Over $11,040 but not over $13,800 |

6% of the excess over $11,040 + $331.20 |

|

Over $13,800 |

7% of the excess over $13,800 + $496.80 |